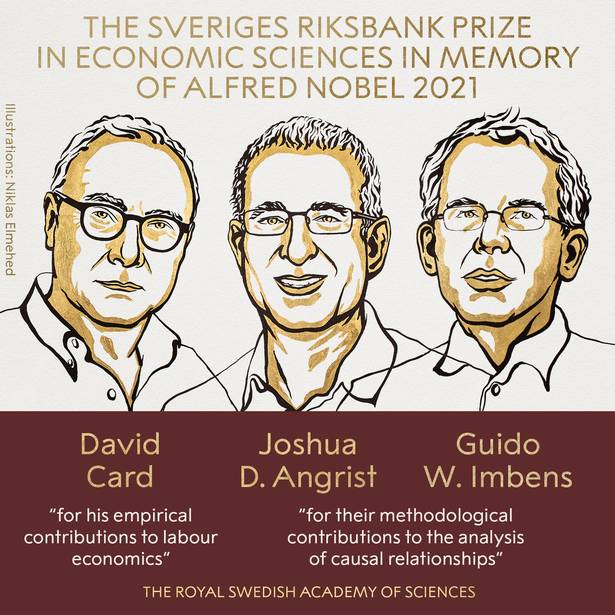

The Nobel Prizes for Economics were awarded back on October 10th but since I was planning to publish a post updating a couple of previous economic stories I decided to wait and discuss the economic Nobels at the same time. By the way, the economic Nobel Prize wasn’t actually established by Alfred Nobel himself but rather was set up by the Swedish government’s central bank in honour of Alfred Nobel.

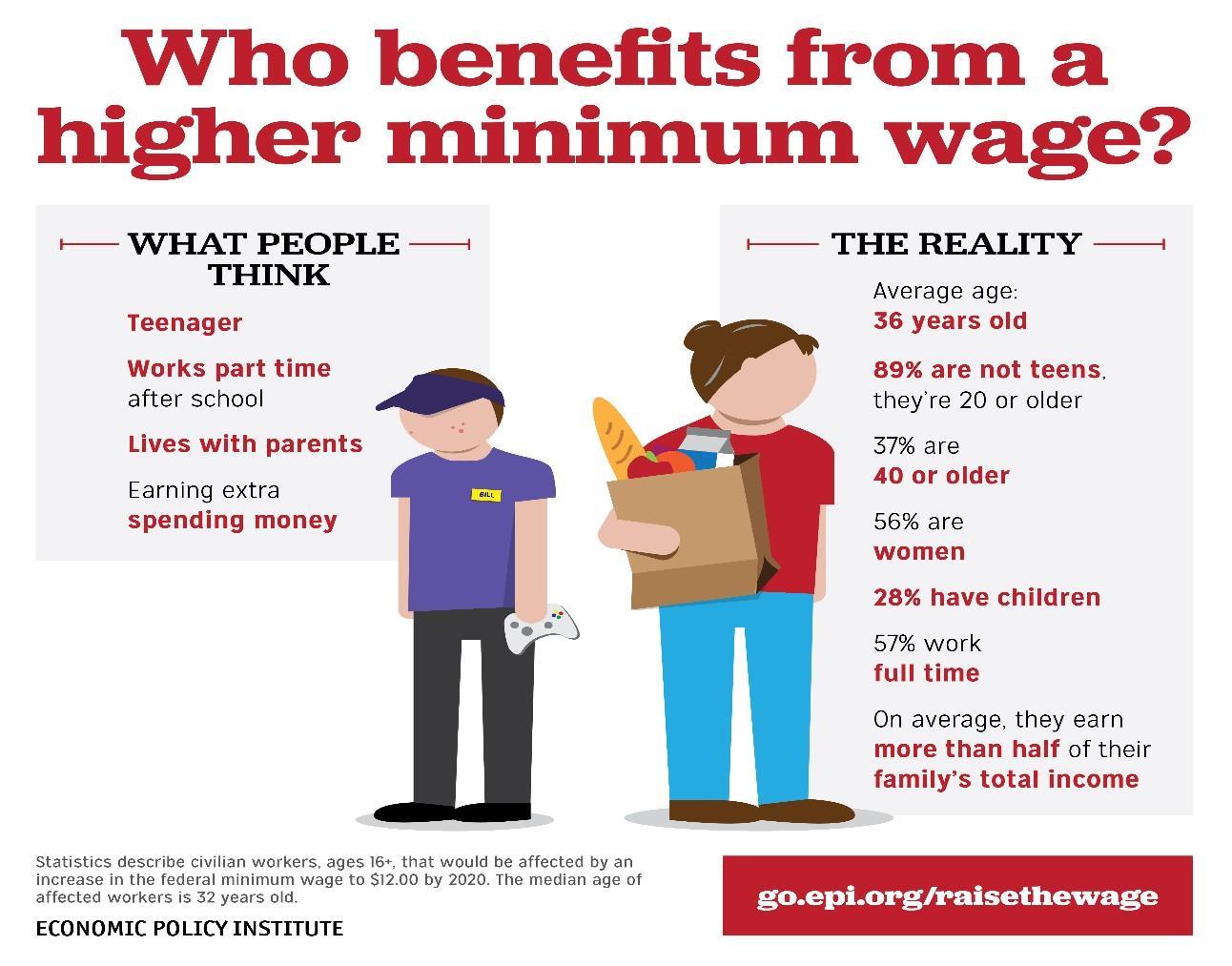

The prize itself this year went to three economists for their work in analyzing actual economic conditions. Half of the prize was awarded to David Card who was born in Canada but now teaches at the University of California in Berkeley. Card’s work dealt with an examination of job growth, or lack thereof in a community whenever the legal minimum wage was raised.

In particular Card studied job growth in New Jersey when that state hiked its minimum wage law in response to economic conditions in neighboring Pennsylvania. What Card found was that, contrary to prevailing theory there was no indication in a slowdown of job creation after the wage increase. Actual evidence that Minimum wages increases were not ‘job killers’ as many economists had argued.

Joshua Angrist of the Massachusetts Institute of Technology and Guido Imbens, born in the Netherlands but now a professor at Stanford University in California shared the other half of the prize. Their work, like Card’s dealt with being able to make precise conclusions from real world economic data, which is often so complex and confused that it is difficult to separate cause from effect.

Together these three scholars have shown how economic theory can be evaluated against real world conditions, an idea without which economics can never become a real science.

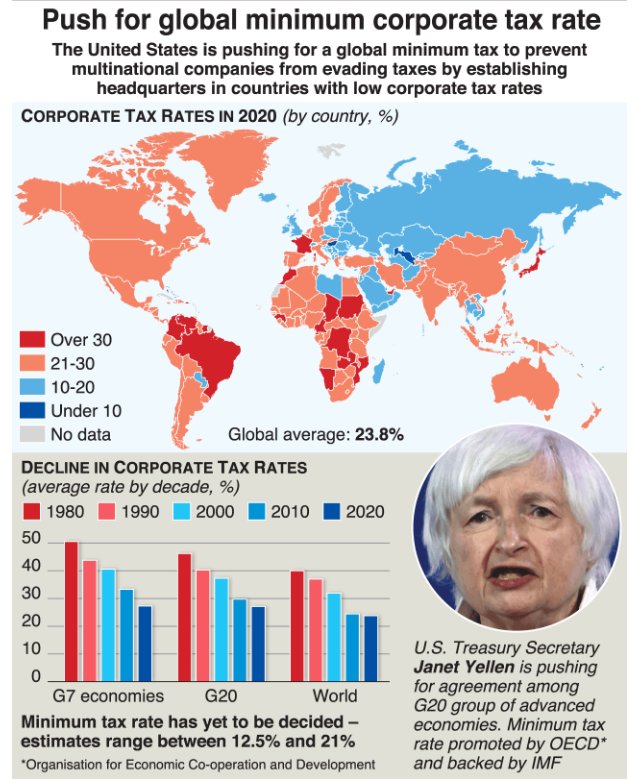

One thing that would help to reduce the complexity of economic data would be if the various legal and political entities, in other words countries in the world would agree on certain economic conditions. Trying to set up such conditions is often referred to as ‘leveling the playing field’ and in my post of 14 August 2021 I discussed one such attempt to establish a minimum corporate tax level of 15% among 136 countries representing more the 90% of the world’s economy. Large economies, like the members of the G8 and G20 groups had long been pushing for such a global agreement in order to counter the ability of small countries to lure in billion dollar corporate headquarters by offering them low tax rates.

Well the deal is done, on October 8th the Organization for Economic Cooperation and Development announced that a final draft of the tax plan had been agreed to by all 136 nations. The final two nations to agree to the plan were Ireland and Hungary, both of whom had benefited by being tax havens for large, multi-national corporations.

The final document not only requires the signature nations to maintain a minimum corporate tax of 15% but also stipulates that corporations must pay the applicable tax rate for any and every country in which they operate, not just the tax rate of that nation in which they locate their headquarters. Concessions to the holdout nations included language agreeing that the tax rate would not ever be further increased and that small businesses, businesses that only operate in one country, could be exempted from the 15% tax.

For my final topic today I’d like to discuss several updates to my previous post about cyptrocurrencies, see post of 16 June 2021. The first event concerns an announcement by the government of China on the 24th of September that cryptocurrencies would henceforth be illegal for any transactions in the world’s second largest economy. What’s going on here is that the Chinese government has realized that cryptocurrencies will be impossible for it to control and are already being exploited by criminal organizations for drug trafficking and cyber crimes in general.

Whether of not the Chinese government is right to be concerned about the growth of cryptocurrencies here in the United States they are becoming ever more mainstream. As a sign of that acceptance the best known cryptocurrency, Bitcoin has since the 19th of October been traded on Wall street as an Exchange Traded Fund or ETF. The Asset Management company ProShares launched the Bitcoin ETF ‘BITO’ making it possible for any licensed brokerage to buy and sell Bitcoin futures just like any other commodity. Similar ETFs had already been launched in both Canada and Europe so the worldwide financial industry seems to have decided that cryptocurrencies are a good way to make money, whether they understand them or not.

As you might imagine, with any valuable commodity that only a small number of people really understand, trying to put a stable price on it is a difficult task. This means that cryptocurrencies are subject to ups and downs caused by the feelings of investors, feelings that often have little or nothing to do with the actual product. This makes cryptocurrencies very volatile, and in fact the price of Bitcoin jumping up and down every day is several times that of even the major stick indices.

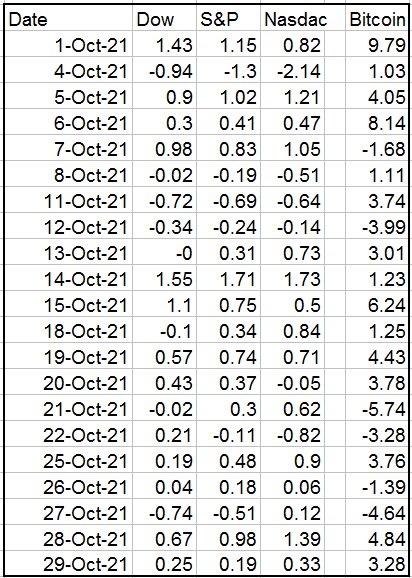

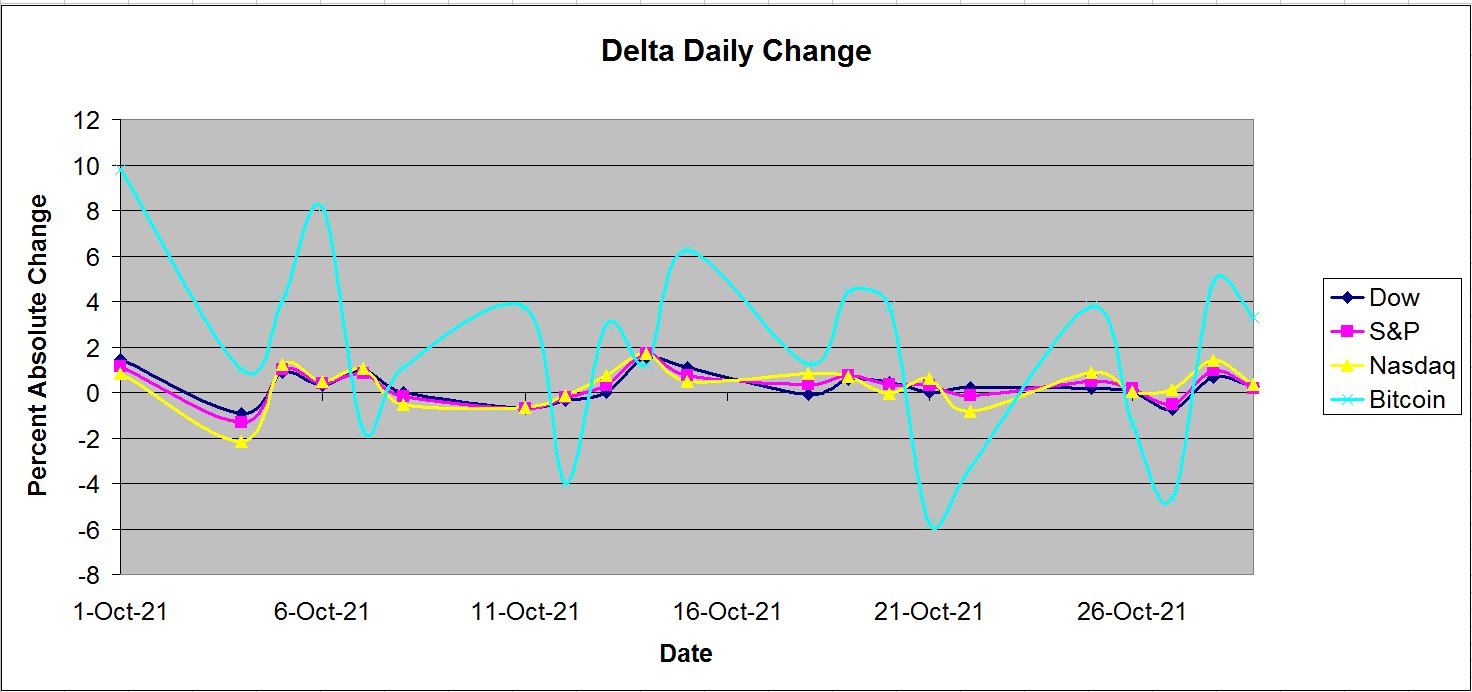

In fact to check that this volatility was more than just my feeling I kept track of the percentage change each day of October for both Bitcoin and the major stock averages the Dow, the S&P 500 along with Nasdaq. The results, as seen in the table above and graph below, were a more than four times greater average change in Bitcoin than for the Nasdaq exchange and more than six times greater change than for either the Dow or S&P 500.

So to anyone out there who might be thinking about investing in cryptocurrency ask yourself this question, do you really want your money to change its value, up or down, by an average of 3¾ percent every day?