In the first two installments of this series of posts I have discussed our nation’s economy over the last 7½ years in an effort to determine whether President Trump or President Biden have done a better job of handling our nation’s economic growth. What I think we have discovered is that neither President’s policies were as important as the impact caused by the Covid-19 pandemic.

In this post I will take a look at the proposed policies of both Trump and Kamala Harris who has succeeded Biden as the Democratic nominee. As can be expected during an election cycle both candidates are promising tax cuts but in almost every other aspect their economic visions for America are very different.

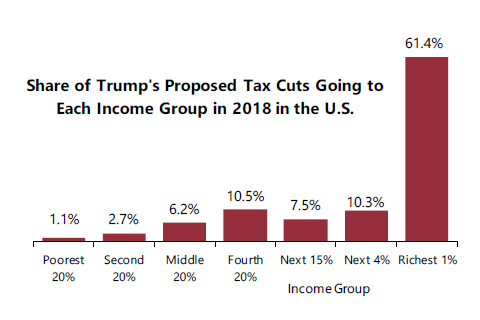

Trump’s proposals are centered around the concept of lowering taxes for everyone, but mostly for corporations and the rich while making the rest of the world pay for it through tariffs on goods imported into the US from abroad. As far as taxes are concerned Trump intends to make permanent the tax cuts on corporations he succeeded in getting past congress in (2018).

Those cuts lowered the corporate tax rate to 21% from 35%, an estimated savings for corporations of $4 trillion dollars that have mainly been spent in stock buybacks that have done nothing more than make stock prices rise. In addition to making his first term tax cuts permanent Trump has also floated ideas about eliminating taxes on tips and overtime although many economists are convinced that the bookkeeping required by such ideas would be complicated and difficult to police properly. In general however, Trump’s tax plans are just ideas with few details about implementation.

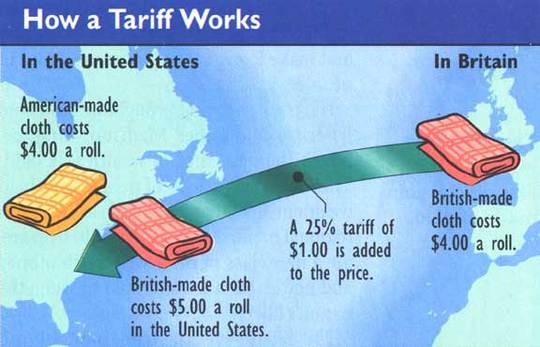

If Trump’s plans for taxes are blurry at least they’re not as crazy as his plan to make the rest of the world pay for them through tariffs, a notion that every economist knows is just flat out wrong. Somewhere back in his days as a student at the University of Pennsylvania’s Wharton School of Business he got the idea that the taxes we impose on foreign goods are paid by the manufacturer in that foreign country. In other words he simply doesn’t understand how tariffs work or why countries use them.

Let me describe a classic example of how a tariff works and why they are used, my example is whiskey! Back in the 19th century the US had a large whiskey producing industry that didn’t want to have to compete against whiskeys from other countries, particularly Scottish and Irish whiskeys from the UK. (By the way there is no such a thing as Scotch, it’s Scottish Whiskey!!!)

In order to get an advantage over foreign whiskey makers the whiskey industry here in the US got the Federal Government to impose tariffs, that is taxes as high as 50% on whiskey imported into this country. Now the whiskey manufacturers in Scotland didn’t pay that tax, they didn’t care whether their product got bought in the UK or the US, and certainly the US has no way of making a company in the UK pay any kind of tax. It is the importer, the person or company who brings the whiskey into the US that actually pays the tariff.

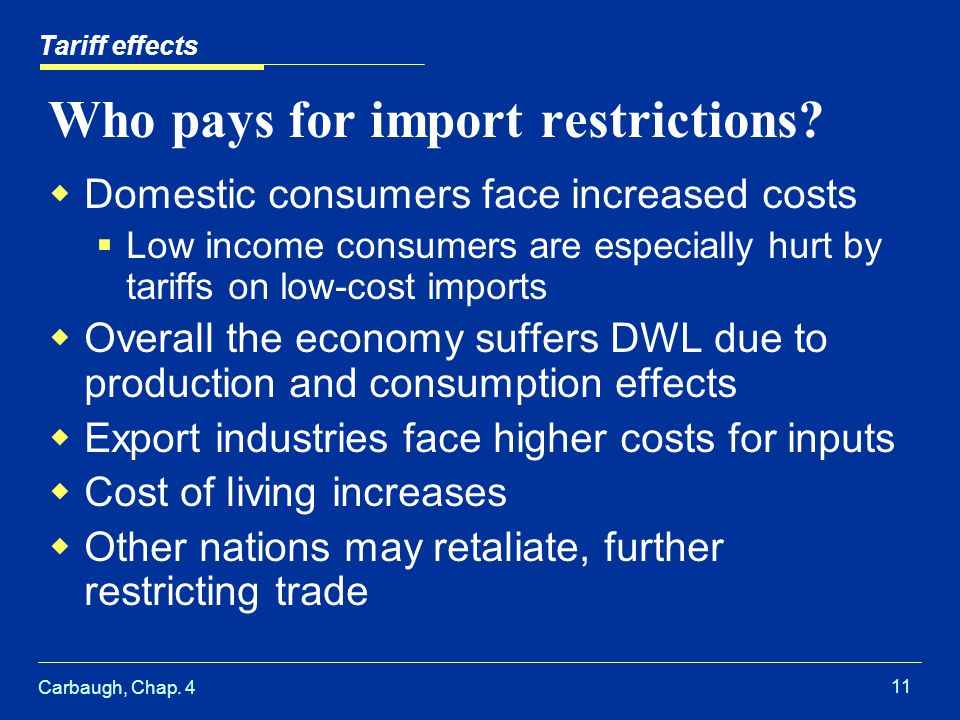

However that importer isn’t going to just eat the cost of the tariff, he’s going to raise the price of the whiskey so he can still make a profit. So the price of the tariff finally gets passed along to the consumer here in America. The idea of the tariff is just that, to make foreign products more expensive so as to give manufacturers here in the US an unfair advantage. Because of that tariffs cause a decrease in foreign goods coming into our country by raising their prices, which is what the whiskey producers here in the US wanted. Nevertheless it is still the American consumer who actually pays the tariff.

And by raising the prices of foreign goods tariffs actually increase inflation, worst still they can lead to trade wars between countries that hurt everybody’s economy. Nevertheless Trump thinks that tariffs are a way of getting other countries to pay us for the right to do business here and he’s gonna do them no matter how bad everybody else thinks they are.

One other policy that Trump is advocating may not seem to be directly connected to the economy but will definitely do so and that is his determination to deport millions of the illegal aliens, Democrats prefer the term undocumented, currently living here in the US. Illegal or not those people are contributing to our economy, they are working, many in jobs Americans don’t want, and they are buying things. Depending on exactly how many aliens Trump succeeds in deporting our country’s GDP could decline by anywhere between 2% to 8%.

Additionally Trump intends for the government to jump start the economy by what he refers to as “Drill baby Drill”, that is to open up federal lands for exploitation by the petroleum and mining industries. In this way Trump hopes that cheaper gas prices will induce economic growth. However the US is already the world’s largest oil producer and it’s questionable as to whether the oil companies will actually want to work harder to pump out more oil in order to lower prices and therefore reduce their profits.

All in all the U of P Wharton School, that Trump attended remember, has estimated that Trump’s tax plans could add $4.1 Trillion, yes Trillion to our national debt while economists at Goldman Sachs estimate that his plan to remove all illegal / undocumented aliens would reduce GDP by about a half a percent in 2025 alone. Finally the Tax Policy Foundation calculates that Trump’s tariff plan could result in a tax on American consumers of $300 Billion a year. And those are all pretty conservative institutions. Again however, it’s hard to figure out exactly what Trump’s policies will do because he hasn’t really announced any concrete plans for economists to analyze.

Kamala Harris’ economic plans could hardly be much more different, although like Trump’s they are also lacking in detail. The one tax initiative that Harris agrees with Trump on is his idea of eliminating taxes on tips. In general the Vice President intends to raise taxes on Billionaires and multi-Millionaires. Specifically her plan is to increase the corporate taxes from their current rate of 21% to 28% in order to fund tax cuts for the middle class. Those middle class tax cuts will come in the form of higher income tax deductions for children, childcare and small businesses.

Another way in which Harris’ plans differ from Trump’s is that she fully intends to continue Biden’s policies of both rebuilding our nation’s infrastructure while also providing incentives to both companies and individuals to help promote a ‘Green’ economy, more solar and wind energy production along with more charging stations for electric vehicles. In addition Harris intends to provide the middle class with incentives for first time home purchases. In many ways however Harris’ economic ideas are adjustments to Biden’s policies.

Well, that’s about all I have to say. I hope these past three posts have given you some clear views about the current state of our economy as well as how much credit, or blame the last two administrations deserve for it. At the same time I have tried to give some idea about the economic plans that the two major party candidates have for how they will handle our economy if they are elected President. Throughout these posts I have tried to be fair to both candidates, whether I have succeeded or not I leave for you to decide.

The most important thing is for you to get out and vote this November, for you to make your choice based upon all of the information you can gather. After all that’s the way democracy is supposed to work!