I went grocery shopping this morning, got $181 bucks worth of food and I paid with plastic. (Have you ever noticed how many slang words we have for money, bucks for dollars and plastic for a credit card?) When I go to actually pay my credit card bill I will just transfer some money from my checking account. And of course the money I receive from my pension, social security and 401K are all directly deposited into my checking account.

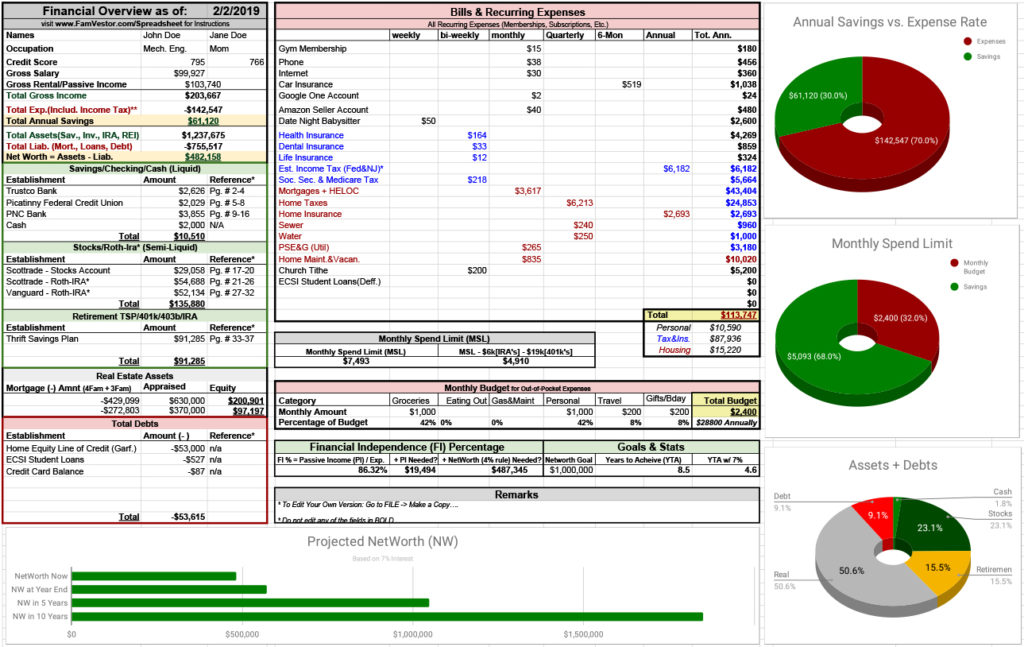

In fact I’m your typical 21st century American, I can receive and spend money in large amounts without ever having to actually touch any of it. It’s all just numbers stored in computer spreadsheets at the grocery store, my credit card company and my bank, and let’s not forget the U.S. Government.

So do we actually need money, cold hard cash anymore? Couldn’t we just do all of our financial transactions on the computer? And is this what these new cryptocurrencies like Bitcoin are all about?

Yes, but with one big addition. You see cryptocurrencies are also intended to remove government institutions, like the US Federal Reserve, from the system. Cryptocurrencies are at the most basic level just a group of individuals and corporations, including banks, who agree among themselves that they will honour the value of the cryptocurrency held by other members of the group. An old fashioned marketplace where barter is the rule like back in the Middle Ages only made instantaneous and international by the Internet.

Of course that’s the way ‘real money’ actually works. The only reason a dollar bill has any value is because everybody says it has, because they have faith in the US government. With a cryptocurrency the members of the group who hold the currency must either have faith in everybody else or faith in a system where everybody monitors everybody else. Ronald Reagan’s old saying of ‘Trust but Verify’ is the key here.

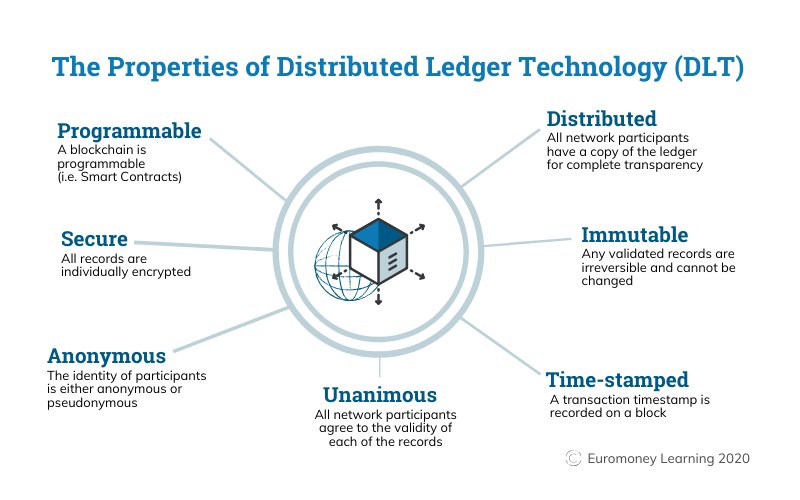

That second option is the secret behind the blockchain, an ever growing list of transactions, each transaction is called a block, that are kept in sequence by means of a timestamp of when the transaction occurred. Since every member of the cryptocurrency group has access to all blockchain records deception by anyone member is impossible, or at least it’s supposed to be.

The blockchain concept was originally proposed back in 1983 by the cryptographer David Chaum in an article entitled ‘Computer Systems Established, Maintained and Trusted by Mutually Suspicious Groups’. The first working blockchain was organized by what appears to be an anonymous person or group of people using the name ‘Satoshi Nakamoto’ in 2008. The blockchain established by Nakamoto now is known and traded as ‘Bitcoin’ and has remained the world’s largest cryptocurrency. Starting in 2008 the blockchain for Bitcoin has grown steadily with each and every transaction being added until in 2020 the blockchain had grown to a size of 20 Gigi-bytes (GB).

If you’re thinking right now that the openness and transparency of cryptocurrency must make it a very honest enterprise, well think again. First of all it’s the computers that trade cryptocurrencies, not people. This allows the person who is telling the computer to trade a cryptocurrency to remain completely anonymous. And even if the exchange of a cryptocurrency is permanently recorded, the reason for the exchange is not. In other words if I give you a bitcoin that transaction will be recorded in the blockchain but what you gave me for my bitcoin is not recorded. For these reasons cryptocurrencies are commonly referred to as being pseudonymous rather than anonymous.

There have in fact been several instances already of cryptocurrencies being used for illegal activities, usually drug trafficking. There are also great concerns about cryptocurrencies being by employed by individuals and states to avoid international sanctions, remember the computers making the transactions are known but not the people controlling the computers.

Other criminal activities have also been associated with cryptocurrency and indeed many economists and financial regulators fear that the entire enterprise could be nothing more than a ponzi scheme. Look at it this way, a cryptocurrency is established by a single person or small group who set up a thousand or more separate accounts, an easy thing to do with a computer.

Those accounts, all controlled by a single entity remember, carry out thousands of transactions making it look as if the new cryptocurrency is very successful. Other Investors, wanting to get into a good thing then purchase large amounts of the new cryptocurrency. The original entity then just takes all that money and runs leaving the investors with nothing but a worthless cryptocurrency.

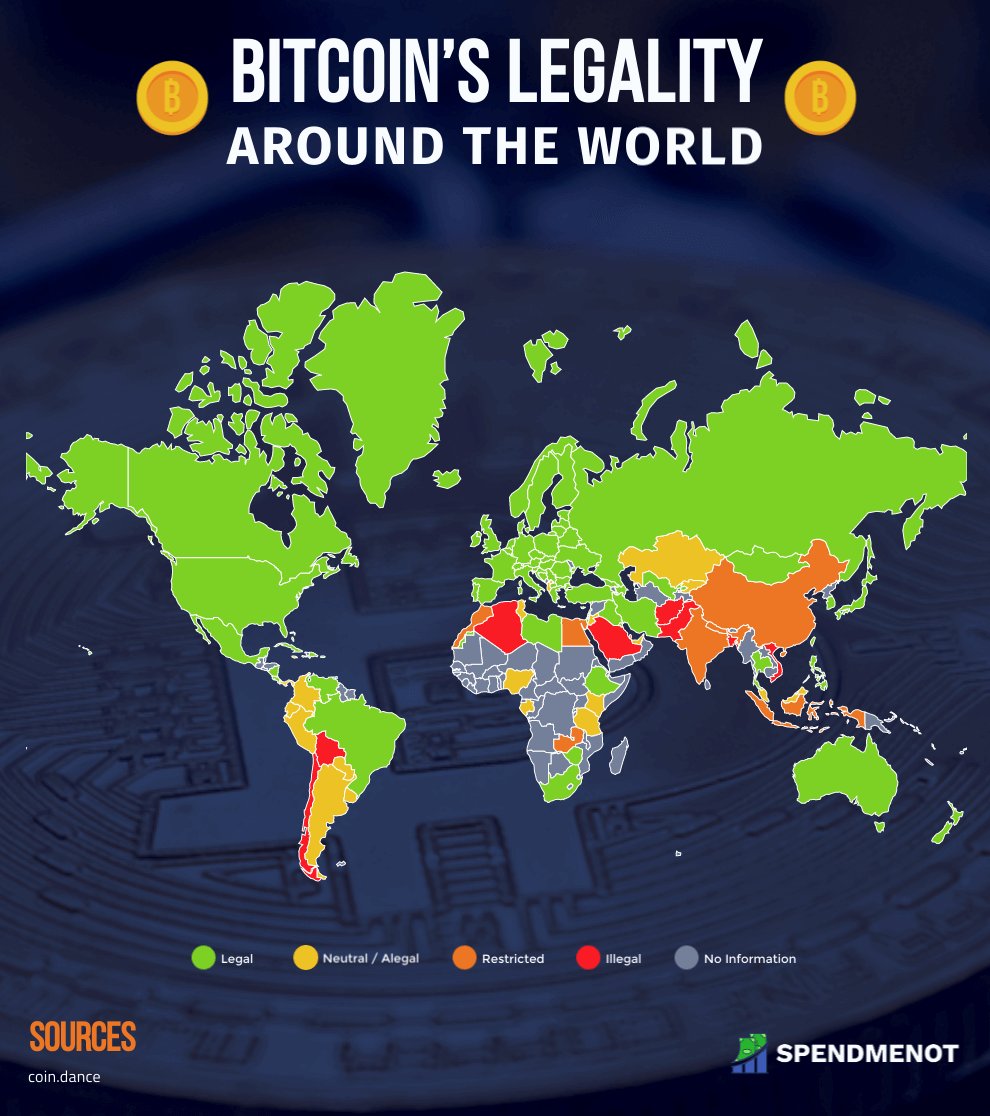

For these reasons governments have in general taken a rather jaundiced view of cryptocurrencies. Many have gone so far as to made trading in them illegal. Egypt, Algeria, Nepal and Pakistan among others have outright banned cryptocurrencies while China, Colombia, Iran, Lithuania and others have prevented their financial institutions for dealing in them, an effective if not outright ban. Additionally the major social media platforms such as facebook and twitter have refused to advertise any cryptocurrency.

In the US and EU cryptocurrencies are currently being tolerated but certainly not welcomed. The rise and fall of the value of Bitcoin, the best-known cryptocurrency, is now being kept track of in the same fashion as the stock markets. Unlike stocks however, which do provide ownership in an actual company, Bitcoin is really nothing but an agreement among its members so the price tends to fluctuate dramatically. On the other hand the nation of San Salvador has decided to accept Bitcoin as legal tender and you can now use it to purchase tickets for the Oakland Athletics baseball team as well.

So, are these new cryptocurrencies the wave of the future or just another get rich quick scheme? Probably both if you want my opinion. Computers and the Internet have given people across the globe the ability to conduct business transactions to an extent never before possible. The use of some form of international currency for those transactions, based upon a blockchain type of security is probably inevitable.

However, at the same time the ability of crooks and con-artists to misuse cryptocurrencies will undoubtedly grow. Because cryptocurrencies are new, even supposed experts don’t really understand them and that’s just the sort of situation fraudsters love. So if you looking to invest some money in cryptocurrencies my advise is to be careful, and don’t put all of your eggs into the cryptocurrency basket.