This is going to be something of a wild post because, let’s face it Trump’s tariff policy has been both incomprehensible and chaotic. The imposition of massive excise duties on virtually every product from every foreign nation one day and then soon afterwards the announcement of a general pause in the implementation of those tariffs, except on China, which three days later got some exceptions, which are only temporary, has left everyone’s head spinning.

Such confusion has generated a great deal of uncertainty and confusion in the business community in general and the stock markets in particular with all of the major markets losing more than 10% of their value within just a few days, and then regaining much of it back. Over a two day period the New York and NASDAQ exchanges lost over $6 trillion dollars, most of which was soon regained. However, the markets have been plagued by volatility ever since.

Now Trump made no secret of his love of tariffs, on the campaign trail he repeatedly claimed that tariffs were his favourite word and asserted that they would be a key element of his plans to ‘Make America Great Again’. Problem is that Trump simply doesn’t understand tariffs, let alone possess any idea of the correct way to use them, see my post of 5 October 24. Trump still insists that it’s the companies in other countries that pay the cost of the tariffs but they just don’t. In actual fact it’s the import firms, usually American companies that pay a tariff fee when a foreign product physically crosses the US border, and those companies almost always pass that cost along to the consumer here in the states.

The whole purpose of a tariff is to make foreign products more expensive than their American equivalents therefore making American products more attractive to consumers. By making domestic products comparatively cheaper tariffs enable American industries to grow stronger. Because of this the very idea of putting tariffs on things that we don’t make here in the US, like bananas, mangoes or coffee beans, is simply stupid. Strong evidence that Donald Trump is simply stupid.

Anyway, let’s see if I can recount the whole imbecilic tale of tariffs, reciprocal tariffs, market collapses, tariff pauses and exceptions and etc. With all of the ups and downs and conflicting signals from the White House I’ll bet that I get a few things wrong but hopefully I’ll remember all of the high points, or should I say low points.

Trump began his trade war almost as soon as he got back into office, quickly putting a 20% tariff on everything that we import from China. He then claimed that the US-Mexico-Canada-Trade Agreement (USMCTA) was ripping off our country. (I guess he forgot that he himself had negotiated the USMCTA) So he imposed a 25% tariff on selected goods from our two neighbors like automobiles, lumber and garden produce. (Again, US farmers grow very few avocadoes so putting a tariff on them is simply stupid) Canada and Mexico quickly responded in kind and the possibility of a trade war with two of our biggest trading partners caused Wall Street to decline.

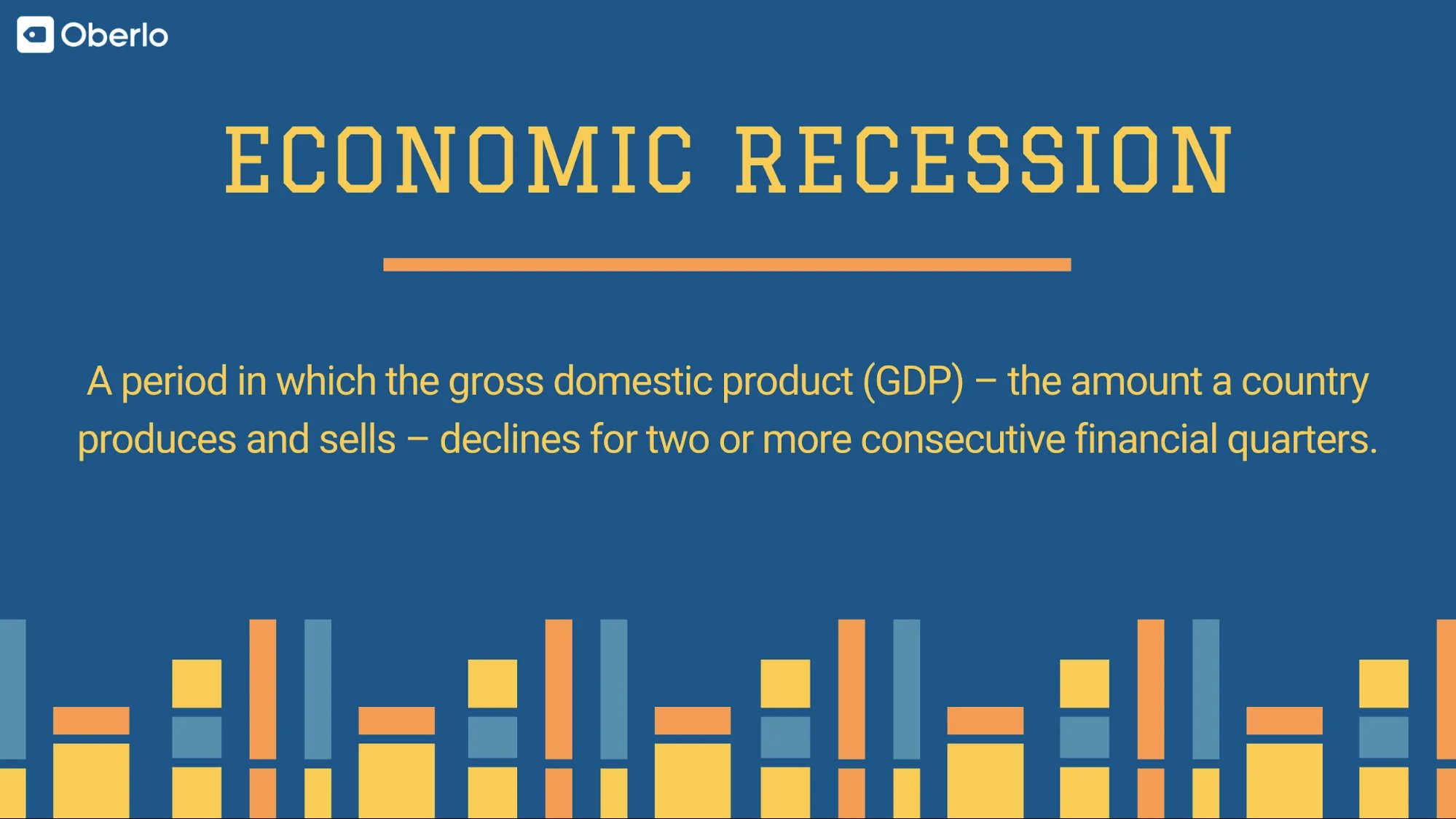

In just a couple of days Wall Street had given back all of the gains that it had made since Trump was elected back in November while at the same time consumer confidence saw a significant drop. Some economists were already suggesting that the tariffs could trigger a recession, although the White House guaranteed that there would be no recession.

It was on Wednesday the second of April that Trump finally announced his reciprocal tariffs, retribution he claimed for those countries that had been ‘ripping us off’ for decades. Apparently every country on Earth has been ripping us off because the long list of tariffs included every nation on Earth along with Heard Island and McDonald Islands off of Antarctica whose only permanent inhabitants are penguins and seals.

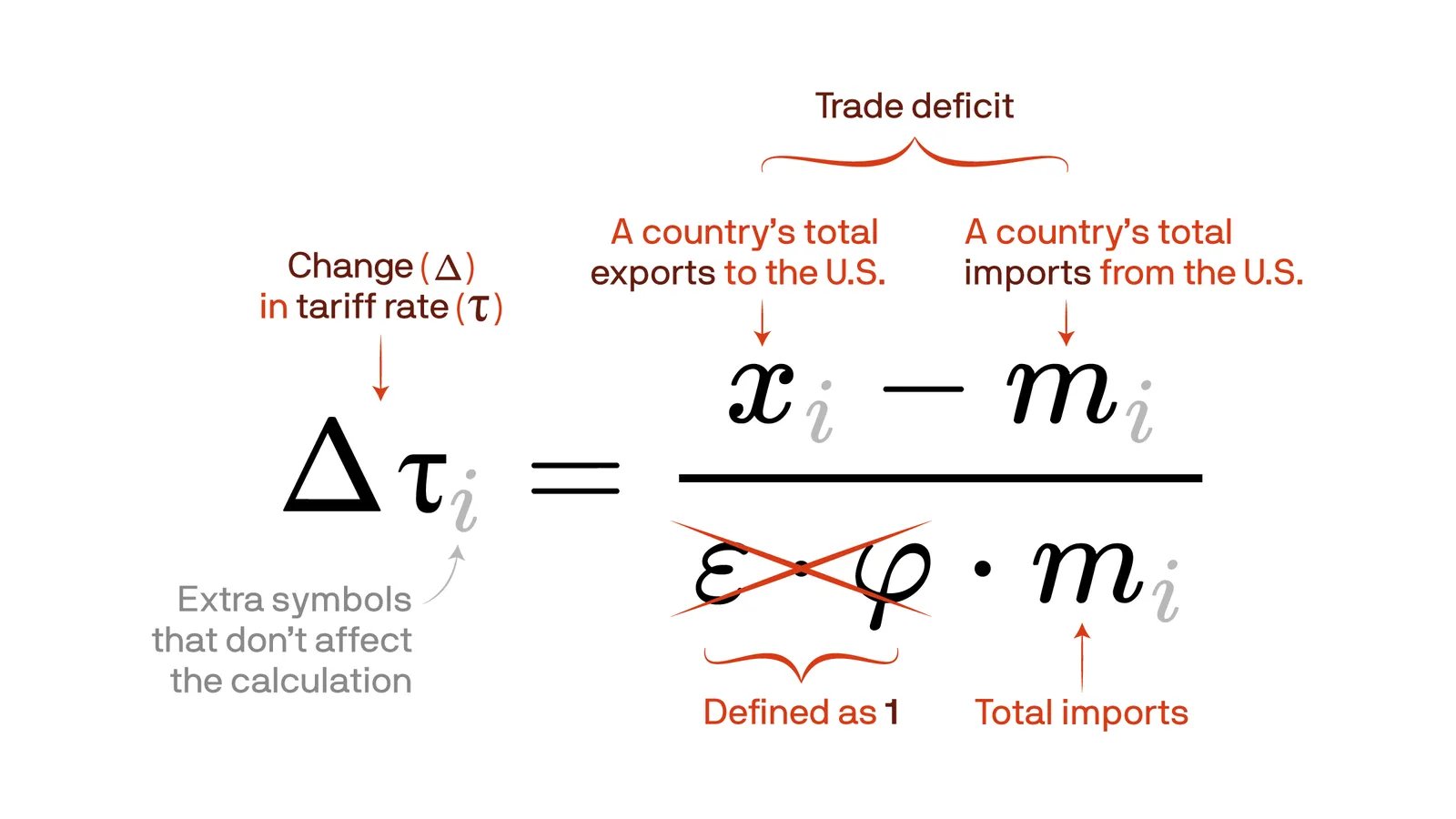

At first the amount of the tariffs each country would have to pay seemed to make no sense to either economists or the media so the White House released a complex mathematical formula that they claimed to have used to calculate the tariff percentage that each country would pay. Although the tariffs are called reciprocal the formula does not in fact include the tariffs or trade restrictions that other countries impose on goods from the US. In essence the formula is just engineered to eliminate the trade deficit that the US has with that nation. The amounts of the tariffs were so large that anyone who understood the economy at all knew that they would simply kill international trade and drive the US into a deep recession if not worse.

In response on the third and forth of April the markets reacted as if they had fallen off of a cliff, all the major exchanges were down by 10% or more. Over the weekend that followed the White House tried to calm the fears of Wall Street by insisting that in the long run the tariffs would make the US economy stronger. Trump himself told the nation that the tariffs were medicine for what ailed the US and that medicine doesn’t always taste good.

The markets weren’t listening and continued their decline so that on the ninth of April, just hours after the new tariffs had actually taken effect Trump issued a 90 day pause on all except the tariffs on China. Trump had backed down in the face of Wall Street losses but the White House couldn’t admit to that. Even as they tried to explain Trump’s retreat administration officials couldn’t agree on the reason for the pause because while trade advisor Peter Navarro and press secretary Karoline Leavitt were claiming that this had been the strategy all along Trump himself admitted that he did it because investors were afraid. Remember that, it was the Wall Street investors who were afraid, not him.

Meanwhile China had decided that it would impose tariffs of its own on US goods, 80% worth. This angered Trump who increased the tariffs on China to 105% and then 125%, I can’t remember the reason for the second jump but China followed suit and now both countries tariffs stand at 125%, I think.

Then on the 12th of April Trump decided to make a few exceptions to the China tariffs, basically for electronic goods. According to Trump the exception is temporary, but no one knows what that means. I haven’t heard whether or not China has responded by given a few exceptions to US goods. That’s the problem with all of this back and forth, up and down, tariffs or pauses and exceptions; it’s nearly impossible to keep up with them. Imagine yourself being a customs agent and a crate of textiles comes into the US from Vietnam, does that agent actually know just what tariff he’s supposed to charge?

All of the confusion and uncertainty is also killing the US’s reputation around the world. First of all there’s the anger that Trump’s bullying is generating among the citizens of countries that thought they were our friends. Travel agencies are reporting that bookings for tourists from Europe and Canada coming to visit the US are way down, which could result in the loss of hundreds of billions of dollars to airlines, hotels and restaurants.

Next year the US is going to host the World Cup in football, my home city of Philadelphia will be the site of six games. What happens however if foreign football fans simply don’t come because of the anger generated by Trump’s trade war. CNN recently broadcast an interview with a Danish citizen who asserted that he had no intention of coming to the World Cup unless “Denmark plays one of its games in Canada.” If that attitude continues the Word Cup could wind up a financial fiasco and America stands to lose a great deal of money.

Even worse, ever since the end of World War 2 the US has been the world’s economic center, with US treasury bonds the world’s safest investment. Anytime the stock market was in trouble, anytime stock prices would fall you would see the demand for US bonds go up as investors sought a reliable place to keep their money. No more, even as the stock markets were losing 10% of their value investors, both foreign and domestic, were selling their treasury bonds. Apparently, thanks to Trump America is no longer considered a reliable, safe place to keep your money. Because of that the value of the dollar is falling against other currencies like the Euro, the Pound and the Chinese Yuan.

Finally, why is Trump doing this? Well, he claims that his tariffs, by making foreign products more expensive, will bring manufacturing back to this country creating millions of good paying blue collar jobs. The lie about American manufacturing jobs going to other countries, Mexico and China get blamed the most, has been around since Ross Perot back in the 1990s. In fact for every manufacturing job that left the US three jobs were lost to robots, to automation. So, even if Trump does succeed in bring manufacturing back to the US the only people that will benefit will be the robots!

So that’s what Trump claims is his goal but in reality he is nothing but a bully, a two-bit hoodlum who has his entire life wanted to use the strength of the United States, economic and military, to extort money from other countries, mostly our friends. Being nothing but a cheat himself he imagines everyone else is cheating him so he feels he has to cheat harder, which is what he really wants to do anyway.

Now the first results of Trump’s monetary policies are beginning to be quantified as first quarter GDP numbers have been released for 2025 showing a 0.3% drop in all economic activity, the first such drop in three years. This economic chaos is just starting. Who knows what Trump will do when his 90-day pause is over? So hang on tight folks, it’s gonna be a wild ride these next three years.