As we here in the US approach our Presidential election I have decided to take several posts to discuss the issues from something of a scientific viewpoint. To that end I spent the last three posts reviewing the state of our economy and the plans of the two major party candidates for dealing with the economy.

In this and my next post I will be discussing the environment and climate change in particular and again the plans that both Kamala Harris and Donald Trump have for dealing with the environment and the growing threat of climate change. In today’s post I will review the current state of environmental issues in the US with an emphasis on climate change and steps that are being taken to contain it.

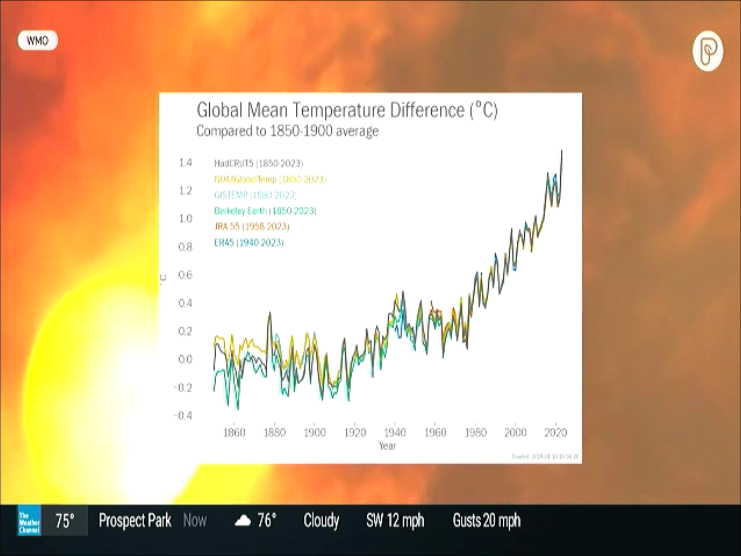

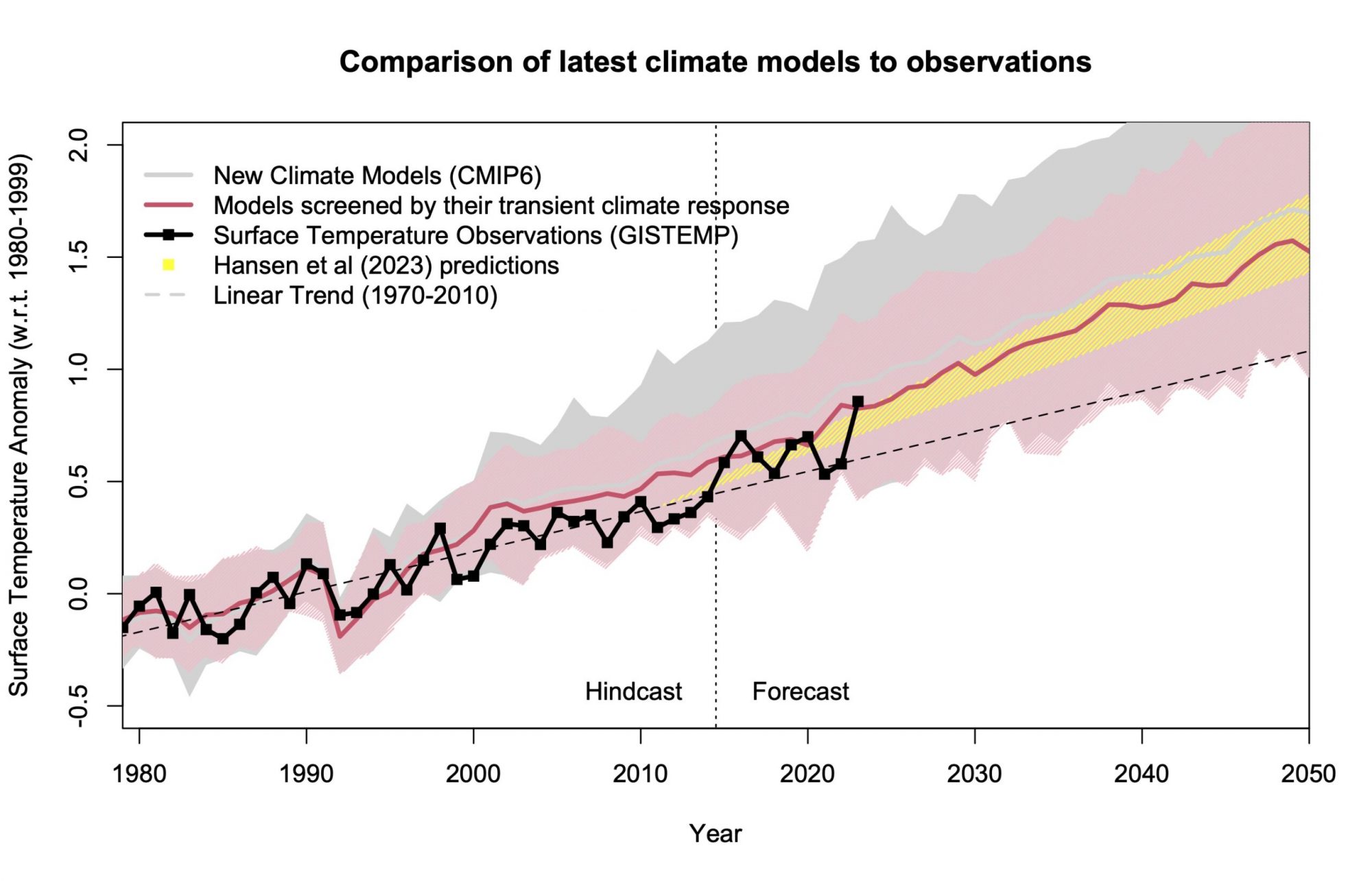

Last year, in 2023 the world experienced the hottest year ever recorded. Strengthened by the Pacific weather phenomenon of El Nino the world’s average temperature came so close to the 1.5º Celsius that scientists have been warning us about for decades that we may just as well as reached it. 2024 hasn’t been any better; in fact the first seven months of the year were each the hottest of that month ever recorded. In other words, February of 2024 was the hottest February ever, April the hottest April ever and so on until July, which was the hottest month of any kind, ever. Indeed, it was on July 21st of 2024 that the Earth’s hottest ever temperature was recorded, beating a record set just the day before.

Locally high temperature records throughout the United States have been shattered. Phoenix, Arizona for example has endured a staggering 113 consecutive days of temperatures above 100ºF (37.8ºC). Las Vegas, Palm Springs and many other southwestern cities also saw record shattering, long duration heat waves. Indeed the record heat pressed as far north as Oregon and Montana. So the last two years have been the hottest years ever measured and in fact the ten hottest years ever recorded have all been in the last ten years, a trend that shows no sign of abating, indeed there is every reason to expect global warming to continue for as long as we keep dumping CO2 into the atmosphere.

As a consequence of this historic heat the death toll due to heat related causes has also risen. Meanwhile that extreme heat has also contributed to the massive wildfires have been raging across the western parts of both the US and Canada.

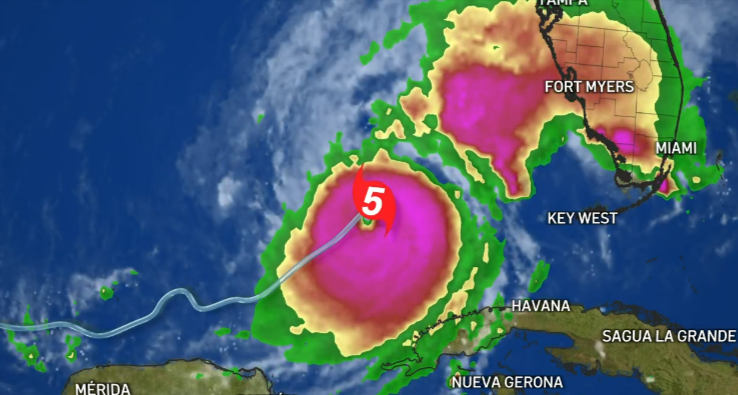

The eastern US hasn’t been spared either with massive outbreaks of tornadoes throughout the spring ranging from Texas and Oklahoma to Georgia in the south and up into Ohio and Indiana. Then, even as tornado season was easing the tropics began to stir bringing first hurricane Beryl to devastate Louisiana then a succession of tropic systems including hurricane Helene that spread destruction from Florida’s gulf coast right up into North Carolina and beyond. Florida’s ‘Big Bend’ region has seen three strong hurricanes in just the last two years causing so much devastation that the people living along the coast haven’t had enough time to recover from one storm before the next hits them. Even as I write these words Hurricane Milton is approaching the Florida coast as a Category 5, another major hurricane that will surely cause enormous damage to areas still recovering from Helene.

Additionally, even as the damage caused by Helene is still being assessed it is clear that the western portion of North Carolina suffered some of the worst devastation. That is despite North Carolina’s being more than 700 kilometers from the part of Florida where the storm came ashore. Clearly the stronger hurricanes and tropical storms that are now being generated by global warming are a threat to communities farther inland than ever before.

Despite all their violence the occasional storm to hit coastal communities only highlights the ever increasing threat from sea level rise. Along the Atlantic coast from Maine to Florida and then around the gulf to Texas land is disappearing and taking homes, often very expensive homes, with it. Cities like Miami, Charleston and Galveston are seeing entire neighborhoods flooded during so-called ‘King Tides’. The state in greatest danger however is Louisiana where it is estimated that one football field’s worth of land is being lost every hour.

Such tides are also turning the groundwater beneath coastal neighborhoods salty and therefore undrinkable. Meanwhile septic systems in the tidewater region of Virginia and parts of Florida are overflowing as sea water again permeates the ground.

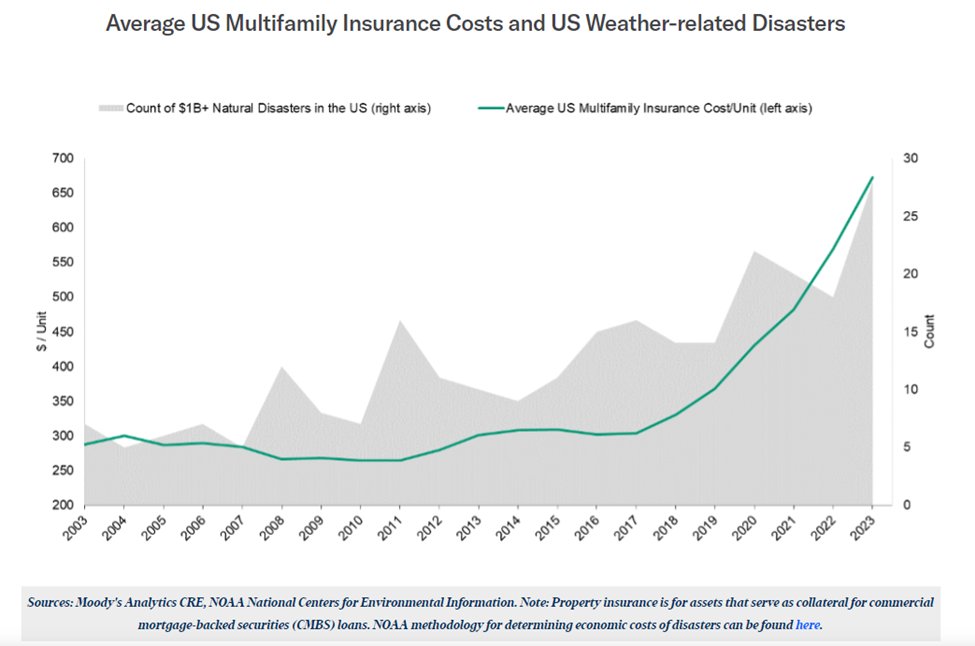

All of this damage to property is causing insurance companies to raise their rates for homeowner’s insurance. That’s if you can find an insurance company willing to insure your home, thousands of homes along the US gulf coast are now considered to be uninsurable. The same is also true for many homes in California and Oregon but out west it’s because of wildfires, not flooding.

That litany of disaster is only from North America; the rest of the world has seen even more extreme weather. Flooding in Central Europe has been the cause of dozens of deaths and entire towns being submerged when a super moist air stream moved north from the Mediterranean and dumped its water on Austria, Poland, Romania and the Czech Republic. Meanwhile in Asia Typhoon Yagi brought flooding and landslides to Vietnam causing the death of 127 people before moving into Myanmar where it caused an additional 110 deaths. Finally in Africa seven days of non-stop rainfall in northern Nigeria and Chad have resulted in the deaths of hundreds, a dam to burst and the displacement of over a million people. A UN investigation has estimated that in total the countries of Africa are losing about 5% of their economies to flooding every year.

And this is only the start; a report published by the CICERO Center for International Climate Research in coordination with the University of Reading in the UK has forecast that in twenty years 1.5 billion people, 20% of the world’s population will be subjected to extreme changes in climate even if CO2 emissions are cut drastically enough for global temperature to remain below 1.5ºC above pre-industrial levels. That’s the best-case scenario, in the event that carbon emissions continue to rise the number of people who will see drastic changes to their climate rises to over 5 billion, 70% of the world’s population.

Faced with such a dire future the world’s governments need to do everything in their power to more than just reduce, virtually eliminate CO2 emissions. In my next post I’ll discuss what the Biden administration has done to help reduce CO2 and what plans both Harris and Trump have for controlling Climate Change.